How to Buy Factor (FCT) - A Beginner’s Guide

Have you been wondering about how to buy Factom (FCT)? Factom protocol is a decentralised, open-source data integrity protocol utilised by the U.S. Department of Homeland Security and the Bill & Melinda Gates Foundation.

Factom aims to create a faster and cheaper alternative to developing dApps on the Bitcoin blockchain. In 2014, Paul Snow and Davis Johnston came up with this data integrity checker system. The system provides opportunities for businesses or governments to preserve their data in an immutable and cost-efficient way. In this guide, you will learn how to buy FCT and where to buy Factom.

5 Steps to Buy Factom Instantly!

-

1Visit our recommended platform to buy Factom by clicking the button below.

-

2Enter your details in the required fields to create a new account.

-

3Fund your account using your preferred payment method and confirm your new balance.

-

4Choose Factom and select a "Instant/Market Order” to buy it instantly.

-

5Enter the amount you want to buy (you’ll see the equivalent in FCT) and confirm your order!

Our Recommended Platform to Buy Factom

If you are new to the world of cryptocurrencies, then you know there are various processes and platforms to choose from to buy Factom. We will walk you through some of the best exchanges and brokers where you can buy or trade FCT. Please find here our recommendations, which are tested and trusted by an expert team to provide our readers with the most reliable and efficient options on the market.

Where to Buy Factom in 2024

There are different ways with which you can approach the market. Investing in a coin, for example, means holding it long-term. This decision is usually the best for those who don’t have time to monitor the market closely. You research a coin with prospects, like FCT, then buy the coin and hold it long-term.

Instead, trading a coin means trying to take advantage of the market’s volatility and acting in the short term. This strategy can gain traders profits if they know how to use technical instruments that the platforms offer and if they are able to predict small variations in the market.

Being fully knowledgeable about cryptocurrencies can help you prevent losses. For instance, many brokers offer contracts for difference (CFDs) as an alternative form of buying cryptocurrency. When you buy crypto CFDs, you do not own the coin, and you cannot store it in a wallet or use it for payments. You can only trade your Factom CFD for a profit against the price movements of the coin.

How to Buy Factom with a Broker

Mainstream cryptocurrency brokers like Coinbase and Gemini do not offer a wide range of cryptocurrencies, Factom included. What you can do instead is buy Bitcoin from one of these brokers and then register on an exchange that lists Factom. You will then use your BTC to buy FCT.

When selecting a broker, you should be aware of their transactional fees. Most brokers offer 0%-1% fees per transaction, other than expenses for buying crypto, transferring crypto, or withdrawing crypto funds.

Security is another crucial factor to consider before selecting a broker. Popular brokers like eToro employ 2-factor authentication (2FA) that adds an extra layer of security to your account. The process requires you to sign in with your password and a security code sent to your phone. When checking the reliability of your broker, make sure also to evaluate how regulated it is and how laws in your area apply to the transactions it offers.

1. Register with the Broker

The first step to start acting on the market is registering on a broker platform. eToro, for example, is a top trading site used by over 20 million users worldwide and is CYSEC, FCA, and ASIC regulated. eToro offers a range of markets, including stocks, cryptocurrency, ETFs, commodities, and Forex, and it is such a popular choice for traders because of its 0% commission fees.

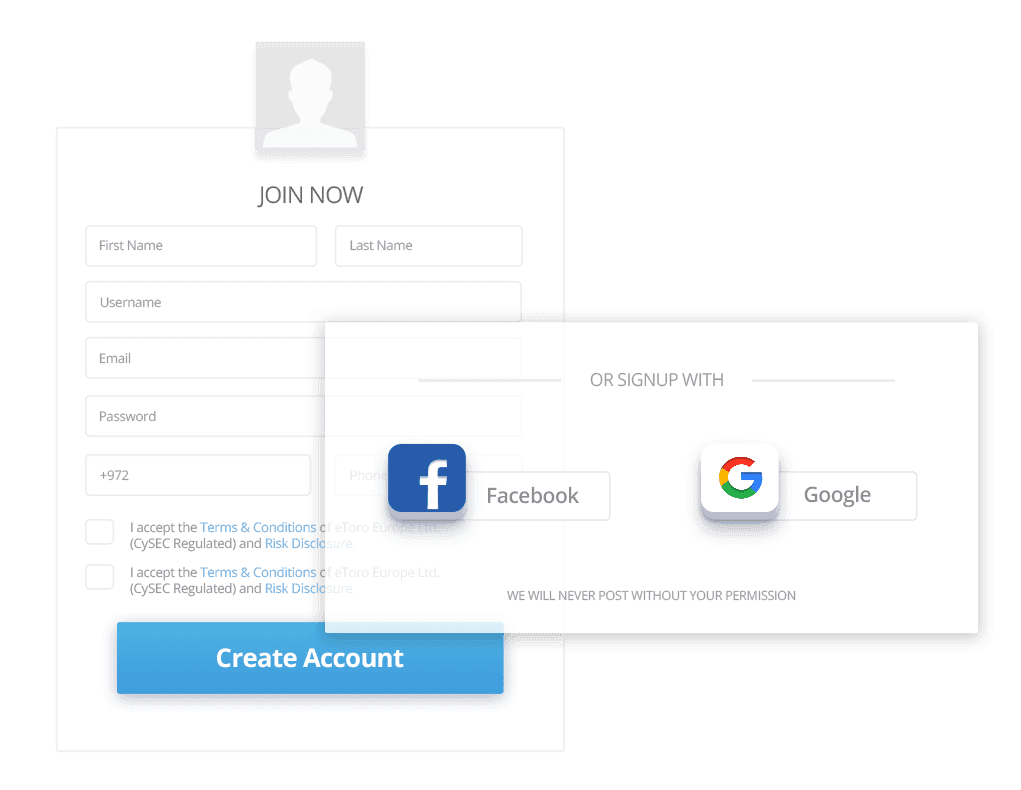

To create a free eToro account, click on “Create Account” and enter all the necessary details. You can alternatively choose to expedite this process by signing up using an existing Facebook or Google account.

Another top contender in the trading industry is Plus500. It requires a very low minimum deposit requirement, and the website’s user interface is easy to use. You can buy/sell CFDs on cryptocurrency in addition to buying stocks, commodities, Forex, and more. Signing up here is equally simple, and requires you to simply enter an email address as well as your personal details to get started.

Once you’ve passed the verification process, your account is officially opened, and you can start trading. You can deposit money into your account and either try the demo version or directly use your funds.

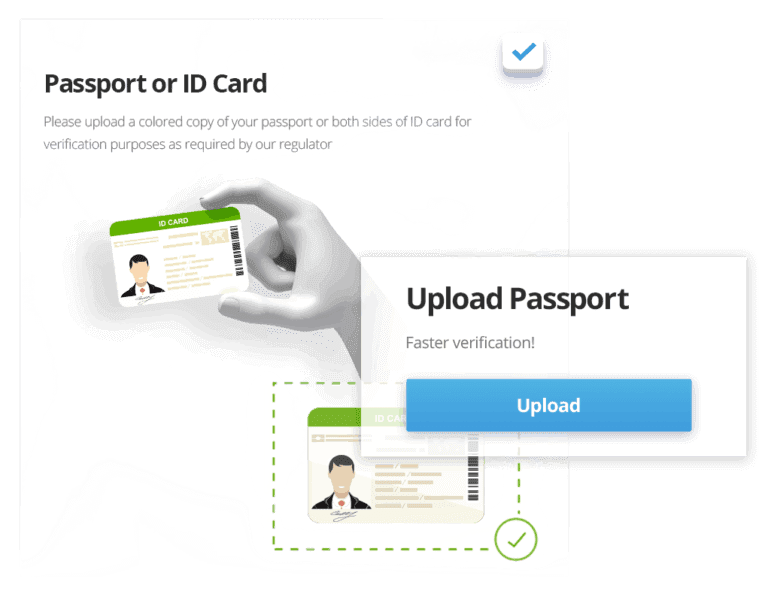

2. Verify your Identity (KYC Process)

Due to the high volume of trading globally, brokerages are governed by regulations that aim to monitor the capital that is exchanged on the platforms.

The regulations that directly impact client registration to a trading site are Anti-Money Laundering (AML) and Know Your Customer (KYC). These regulations require companies to carry out account verification procedures regarding their clients to establish their identity. This information gathered from the trading sites is run past a regulatory database to find fraudsters or criminals.

KYC documents required to confirm a client’s identity may include, but are not limited to:

- A passport, driver’s license, or other photo ID to prove the identity of the client

- A recent utility bill to act as proof of address

- A valid email address

- Other financial information such as the purpose for opening a trading account and source of funds

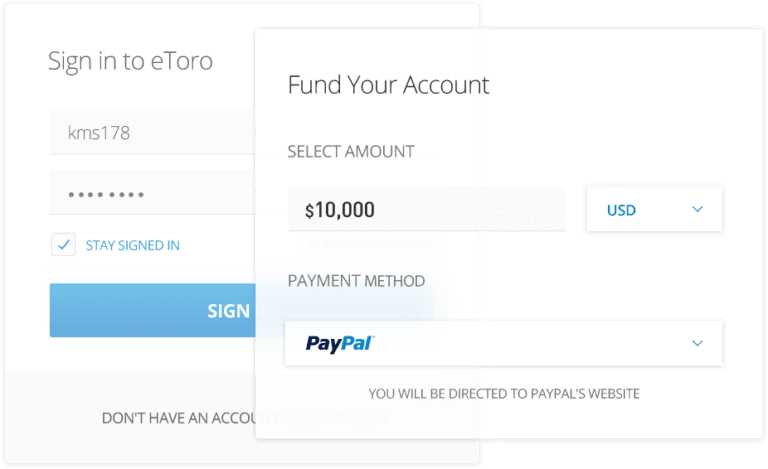

3. Deposit Funds with your Preferred Payment Method

After registering with your broker, you can select your preferred payment method from a list of options. Most brokers accept debit cards and credit cards. PayPal, Skrill, and other e-wallets are convenient but may apply higher fees. If you haven’t yet registered with a broker, you can check their site for this information. You can find information regarding payment methods and the fees they apply on the FAQs page.

4. Open a Position to Long/Short Factom

You can open a long or short trade on Factom based on your fundamentals or technicals. A trader who opens a long position seeks to profit from a rise in the coin price. A trader who opens a short position or goes short seeks to profit from a drop in the coin’s price.

You can buy cryptocurrencies and open long positions without leverage. This is usually the best decision for newbie traders who don’t understand the price volatility in the market. If you want to own a Factom token and hold it because you believe in where the project is headed, open a long position.

Brokers like eToro offer CFDs to those that desire to open short positions. Shorting or opening a short position means that you want to trade against the price movements in the market. You don’t plan to invest in the project, but simply to profit from its price movements.

Both strategies are great ways to buy and trade a coin; however, trading with CFDs is better suited for expert traders who understand the market more.

5. Close your Position

Closing your position refers to exiting a trade. For example, if you have purchased FCT tokens and their value has increased to a level with which you are happy, you can sell your position and take the attendant profit. If you are using a CFD, you can simply press the “close” button, and the difference between the opening and closing price of FCT will be used to determine your profit or loss.

You can use the stop-loss and take-profit functions to automate your trading. These limits will automatically close your trades for you when you have reached a certain profit or loss threshold that you specify beforehand.

How to Buy Factom with an Exchange

To buy Factom from a cryptocurrency exchange, you must first check if the exchange platform you have chosen lists FCT. If they do, then you can proceed. Analyse the features and transaction fees of each exchange to decide on the one that’s right for your needs. Then you can register for an account by entering your email address and creating a password. Note that to buy Factom you will have to buy Bitcoin first as it is the only trading pair available to buy FCT.

When registering with an exchange, you may be required to provide further personal information (such as your name and full contact details) and proof of ID before you can start trading. This step is crucial in fulfilling Know Your Customer and anti-money laundering regulations.

1. Set up a Factom Wallet

As a cryptocurrency owner, your wallet will become your new best friend. A crypto wallet ensures that your savings are hackproof and safe if you follow the right security procedures and choose the right one for you. There are two types: hardware and software wallets.

Hardware wallets are considered the safest place to store your crypto, as they are “physical” wallets to which you upload your cryptocurrency, and it is impossible to hack them, due to the lack of internet connection. With a cold wallet, you will be able to generate your own private key to access your funds and, eventually, put them back on one of your trading accounts whenever you need to.

Software wallets are more straightforward and convenient: they store your cryptocurrency and private keys directly on your device. Soft wallets utilise the cloud or a server to store user data and information which require an internet connection to access, use, and manage them. Many of them can be directly connected to exchanges to allow for a smooth transfer for crypto holders who want to trade.

Most people who buy crypto through exchanges tend to store their crypto in the exchange wallet. However, you can still download a software wallet to protect your crypto assets. In the event that the exchange is hacked, your crypto will be safe with you.

2. Choose and Join an Exchange that sells Factom

There are many leading exchanges where you can buy Factom (FCT). Some notable exchanges include Binance, Bittrex, Coinbase and so on. Each of these platforms offers different services and features, so take the right amount of time to evaluate the option that best suits your needs. Also, learn about their trading fees and commissions and evaluate the best combination for the strategy you plan to use.

3. Choose Your Payment Methods to Buy Factom

Many exchanges like Binance offer a number of payment options for you to exchange fiat currency for FCT. Some funding options include Debit/credit cards, bank transfer, peer-to-peer trading, cash balance, and third-party payments. For example, buying crypto through your Debit/credit cards is pretty straightforward, but it incurs a high cost per transaction. Regardless of where you are from, there is a perfect payment option that will work for you. It is best to do your research for any fees associated with the transactions you want to make.

4. Place an Order to Buy FCT

Once you’ve followed the steps above, you should be ready to buy FCT. After your account is verified with an exchange, you can add funds to your wallet to buy BTC, which you will then exchange for FCT. You may purchase the coin by placing a market order. Placing a purchase order is mostly the same across all exchanges, with minor variations.

5. Safely Storing Your Factom in a Wallet

As we mentioned earlier, most exchanges provide a web wallet where you can store your investment. However, if you intend to hold your coin for long-term investments, it will be wise to save your digital currency in a private wallet. It can be either a hardware or a software wallet, but note that this is an optional step: your tokens can be stored directly in the exchange where you got them from, but for those that wish to buy and own cryptocurrency for a long period of time, this option may not be wise.

Should you Buy or Trade Factom?

Factom may be purchased in two ways. You have the option of buying and holding or trading. Buying and holding is a fundamental analysis-based long-term investing approach. The investor chooses which currency to purchase based on basic aspects such as blockchain technology, liquidity, and renewable energy mining. Those who buy and hold overlook short-term price fluctuations.

Traders, on the other hand, use technical indicators to profit from market volatility. Traders use technical indicators like the RSI, MACD histogram, volume, and Bollinger bands to enter and exit positions faster, resulting in smaller, more frequent profits. Our advice is to only put the money you can afford to lose in the crypto coin you want to trade.

What’s the Difference Between a Factom Exchange and a Broker?

Factom can be purchased or traded on exchanges or through professional brokers. A cryptocurrency exchange is an online marketplace where traders may buy and sell cryptocurrencies. Exchanges are similar to a marketplace where traders and speculators come together to conduct business. They function as intermediaries between buyers and sellers, charging a fee for each transaction that takes place on their site.

A professional broker, on the other hand, is an individual or organisation that provides traders with access to cryptocurrencies. He serves as a go-between between the trader and the market. Traders who acquire cryptocurrencies through brokers do not generally want to hold the coins; instead, they want to benefit from price fluctuations. Unlike on an exchange, where traders who acquire coins control the coins, this is not the case, as brokers facilitate price exposure using derivatives such as CFDs.

Factom: Long Vs Short Term Investment

Long-term and short-term investments are both potentially viable with Factom. A long-term investment is one in which you keep your money for several months or years. On the other hand, short-term investing is an investment strategy with which investors retain their FCT position for a short period, which can range from minutes to a year.

Make sure you know your strategy and stick to it! We all have a unique approach to how we buy or sell crypto coins. No one is wrong or right, as long as it is safe.

Factom has a Circulating Supply of 9,788,273 FCT. It is interesting to note that coins with a limited supply tend to do well over time. With an all-time high of $87.16, there is much room for growth in the Factom project.

Buying and investing in a coin simply depends on if you believe in its future. On the opposite side, trading is betting and making a profit from price movements.

3 Tips to Buy Factom

Before buying Factom make sure to read our 3 tips to help you have a smooth journey into the market.

1. Choose the Right Time and Do Your Own Research on Factom

Taking time to research a coin will help you make more informed decisions. You will learn more about the project you are investing in and see the direction of the project. Before buying, take the time to observe the market, the latest trends, and data like the all-time highs and lows of the cryptocurrency you’re interested in. Finally, evaluate if the moment is right to make your move or if it is better to wait for a dip in price.

2. Compare Costs to Buy Factom

When trading cryptocurrency, transaction fees are an overlooked cost. Liquidity, broker or exchange fees, payment processing, and the bid-ask spread are all factors that impact transaction costs. You should balance payment method costs according to the convenience and security that you need: credit cards, for example, have higher fees, but are highly convenient and very secure.

3. Safety and Security when Buying Factom

Money and coins must be kept safe and secure at all times. A poor approach to wallet security and safety might result in the loss of your funds. When looking for a broker or exchange to acquire coins from, this should be one of your top objectives. It’s best to choose systems that have several levels of protection. Ensure you sign up for a 2-factor authentication code, add extra layers of security to your account, and never share your passwords.

What is the Best Payment Method for Buying Factom

- Buy Factom with Cash: Buy BTC from a local trader using cash, and then use your Bitcoin to buy FCT

- Buy Factom with Credit Card: Higher fees, but fast payments and added fraud protection

- Buy Factom with Bank Transfer: Simple, safe, and low-cost, but oftentimes slow

- Buy FCT With Bitcoin: Exchange Bitcoin for FCT tokens

- Buy Factom with PayPal: Convenient and safe, but not available everywhere

Other Ways to Buy Factom

There are more options for getting bitcoin besides buying them straight from exchanges and brokers. You have the option of mining for cryptocurrency. Setting up mining rigs and solving difficult mathematical calculations that reward you with coins are both parts of this process. You may also decide whether to stake or pool your money.

A peer-to-peer (P2P) network may also be used to purchase coins. P2P exchanges allow buyers and sellers to transact directly. The exchange serves as a middleman, connecting buyers and sellers. A buyer sends the appropriate amount to the seller, who then deposits the coins in an escrow account. After the payment is completed, the cryptocurrency will be released to the respective owner.

When investing in crypto, it is always better to be well researched. Stick to exchanges that are regulated. Stick to coins with fundamentals. Do not get enticed by coins with promises of huge gains; they are usually scams. Do your own research, and finally, only invest what you can afford to lose!

Frequently Asked Questions

-

Buying Bitcoin first allows you to then trade BTC for Factom (FCT) tokens.

-

Brokers are different from exchanges. They offer other markets like Forex, Stocks, ETFs, unlike exchanges that deal primarily with cryptocurrencies.

-

For now, yes. Factom can only be bought with BItcoin.

-

No, you cannot. You must first convert your ETH to BTC to buy Factom.

-

Yes, if you plan on a long-term investment then this would be prudent. However, if you want to trade FCT, it will be difficult to do so with your coins in a hardware wallet.

Alternative Cryptocurrencies