How to Buy BlackCoin | Ultimate Guide To Buy BLK

Almost five years after Bitcoin launched, concerns about energy consumption through mining and slow transaction rates began to spawn new cryptocurrency projects. BlackCoin is one of these projects founded in 2014, after a Novacoin fork. Instead of depending on proof of work (PoW) for consensus, BlackCoin moved to a hybrid of PoW and proof of stake (PoS), and later to pure PoS.

Over the years, BlackCoin (BLK) has gained a substantial following and now many want to own a piece of the project. If interested, this step-by-step guide will show you how and where to buy BlackCoin.

5 Steps to Buy Blackcoin Instantly!

-

1Visit our recommended platform to buy Blackcoin by clicking the button below.

-

2Enter your details in the required fields to create a new account.

-

3Fund your account using your preferred payment method and confirm your new balance.

-

4Choose Blackcoin and select a "Instant/Market Order” to buy it instantly.

-

5Enter the amount you want to buy (you’ll see the equivalent in BLK) and confirm your order!

Our Recommended Platform to Buy BlackCoin

The primary goal for this guide is to highlight BlackCoin, and more importantly to show you how to buy the BLK tokens. But if you are reading this guide solely to know which platforms we recommend, then let us not waste your time. The following are our recommended platforms to buy BlackCoin:

Where to Buy BlackCoin in 2024

Some investors buy BlackCoin (BLK) tokens for long-term possession. It is possible to buy the coins from a cryptocurrency exchange for long-term keeping. Investors who choose to go this way often follow the long-term investment approach. The aim here is to hold the coins for as long as possible until the price is high enough to generate the desired profit margin then dispose of them.

Buying BlackCoin for long-term holding confers some interesting privileges to the investor. First of all, your wealth increases each time the BLK price rises. If, for example, you acquired the tokens at the launch of the BlackCoin blockchain project, the value of the holding would be 582.21% higher as of 23 May 2021. Another benefit of buying BlackCoin from an exchange is that you get to keep the actual digital currency. As such, you can spend the coins to purchase other items over the internet.

On the flip side, owning BlackCoin tokens is cumbersome, because you have to set up a BlackCoin wallet for storage of the tokens. Now, cryptocurrency wallets are easy to understand, but the problem arises from too many options. The process of identifying the right wallet requires extensive research, which consumes time that some might not have.

If the downsides of owning BlackCoin seem like too much, there is an alternative: BlackCoin trading. Trading BLK tokens is an iteration of buying the cryptocurrency. The main difference with the first iteration we have just discussed is that the latter case does not involve the actual tokens. Instead, you will get exposure to the cryptocurrency by trading its price movements.

Professional cryptocurrency brokers offer the perfect platform for trading BLK’s price gyrations. The brokers package the instrument as contracts for difference (CFDs). CFDs are derivatives that merely reflect the price of the underlying asset, in this case, the BlackCoin tokens.

BlackCoin CFDs have one main upside, which is convenience. Since you are not taking physical delivery of the tokens, there is no need for BlackCoin wallets.

How to Buy BlackCoin with a Broker

If BLK trading is your cup of tea, then it is time to begin familiarising yourself with cryptocurrency brokers. For your information, cryptocurrency brokers have fiduciary obligations to their customers, for which they charge fees. As such, the right broker should be the one that charges within an affordable range. You will also notice that the brokers require regulatory licenses because of the nature of their work. Therefore, it is prudent to ascertain the regulatory status of the broker before signing up.

1. Register with the Broker

Having been satisfied with your choice, it is time to create an account. Please think of the account as your identity on the broker’s platform. The broker will use this identity when executing orders and settling transactions on your behalf.

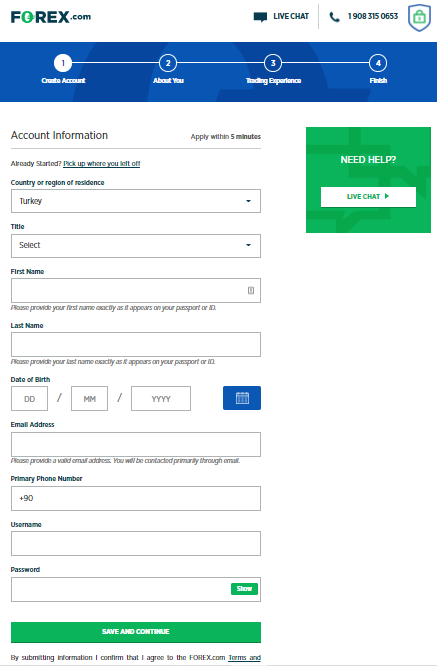

The typical account creation process entails opening the broker’s website and clicking on the “Create Account” button. Next, a small window will open in which you have to enter the required information. However, some brokers such as Forex.com will bring you a massive window whose scope of information required is substantial.

Compare this window with Pepperstone. The first instance in the account creation process on Pepperstone is simple and less exacting. All you need is an email address and then move onto the next stage.

2. Verify your Identity (KYC Process)

The same way they differ at the registration stage, the brokers follow unique paths when it comes to verifying your identity – although the ultimate goal remains to avoid frauds and money launderers. Typically, the brokers ask for identification information issued by the local government. For proof of address, the brokers often ask for recent bank statements, tax bills, or utility bills. While some brokers will ask for all of the documents mentioned, others might ask for two at most – one for proof of identity and one for proof of address.

The technical term for the identity verification process is ‘Know Your Customer’, or KYC for short. Brokers implement the KYC process because regulations demand it. However, the main reason for the KYC process is to sanitise the trading platform so that it is free from criminals. The more the brokers keep their platforms clean the more people will want to join the BlackCoin trading community.

3. Deposit Funds with your Preferred Payment Method

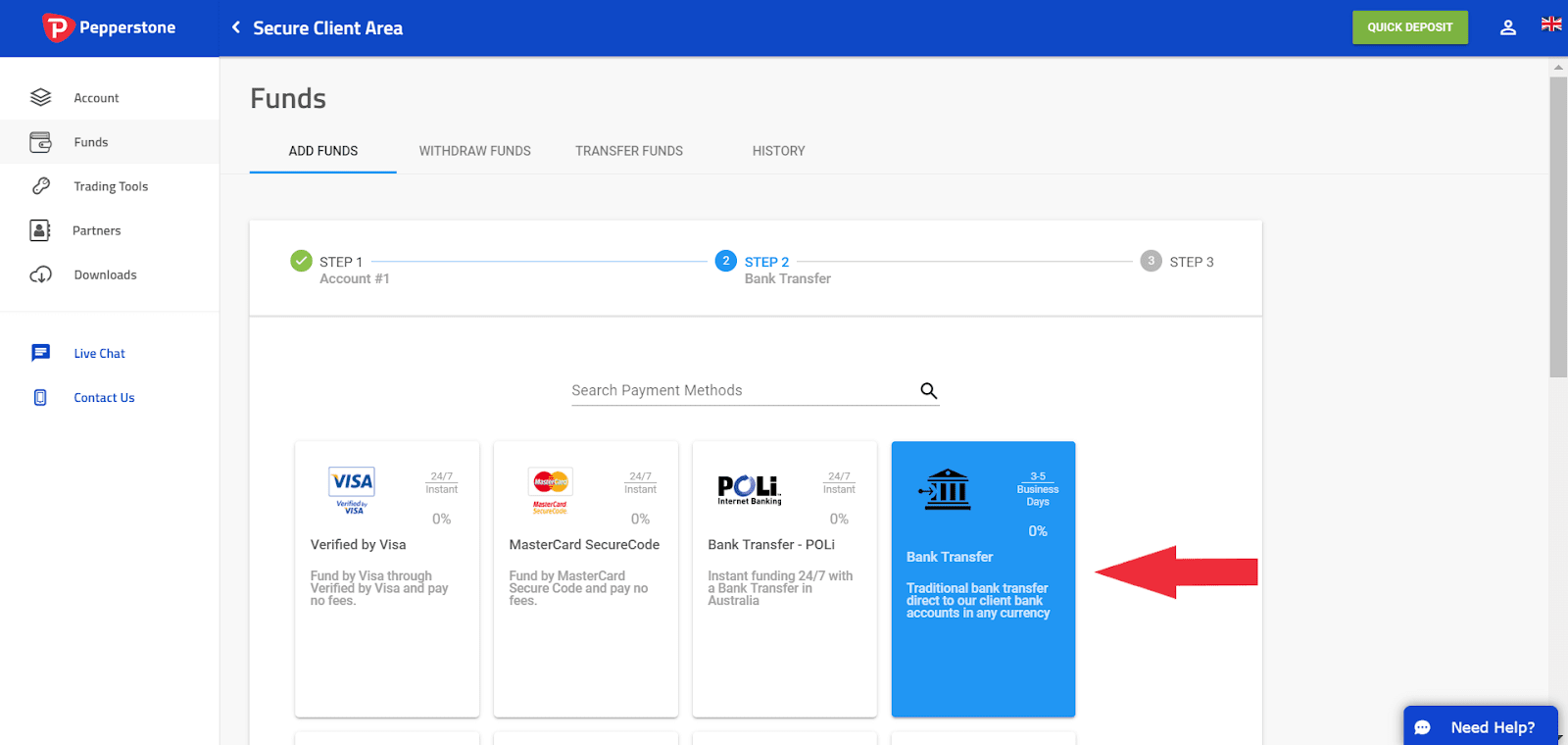

The next step after setting up the account successfully is to start trading, but not before uploading funds. If you chose Pepperstone, for example, you should be able to access the secure client window. Under the ‘funds’ tab just below ‘Account’, the window provides all the payment methods available for your selection.

As you can see, you have several options from which to select your preference. If it helps, please note that each payment method completes transactions at different rates, and the fees charged also differ. It is, therefore, incumbent upon you to conduct exhaustive due diligence to establish which option offers the best speeds at manageable costs. In terms of security, most of the payment methods provided are safe, although you should take caution nonetheless. Additional security measures you could take is to ensure your computer has proper protection from strong and up-to-date antivirus.

4. Open a Position to Long/Short BlackCoin

The beauty of trading BlackCoin CFDs is the ability to make profitable trades on either side of the market – when the BLK price rises or declines. A long position refers to the trade you make and can only generate profit when the BlackCoin price increases. In other words, the position reflects confidence in the future value of the digital currency.

Short positions take place on the opposite side of the market. When you go short on BlackCoin, you are conceding that the future value of the cryptocurrency is likely to decline. This position can generate profit only when the price of BlackCoin falls.

Long positions come with one main advantage, which is that the trade can generate an unlimited amount of profit. There is no ceiling to how huge the BLK price can get. As the price rises, the trade volume climbs, and more buyers join the band to earn a piece of the value. A chain reaction could erupt and finally propel the price of the token into the stratosphere.

Short positions, on the other hand, enable traders to exploit the BlackCoin bear market. If you had a long position on BlackCoin and the price began to decline, you could short the digital asset to hedge the former position. Nevertheless, the short position stops being profitable when the BLK price hits the floor.

Fortunately, some professional brokers have mechanisms in place to help newbies to participate in the market even without technical information. The features allow traders to copy the strategies of others and be able to attain the same outcome.

5. Close your Position

Opening a position at the right time often leads to substantial gains. Making the trade is just one-half of the trading process because closing the position is as critical. Close the position too early and you fail to achieve the maximum gains; close too late and you could lose all your capital.

However, such problems only arise when you rely on the manual execution of the trades. Instead, you could use the stop-loss and take-profit orders to automate the process of closing your position. A stop-loss order is critical especially when you are short BlackCoin because the potential for loss-making is unlimited. The order executes automatically when a given price point is triggered. For the take-profit order, it is ideal when you are long BlackCoin. The order closes your position at a predetermined price to avoid too much greed.

How to Buy BlackCoin with an Exchange

You buy BlackCoin through an exchange when you want the actual tokens for a long-term investment. With several exchanges in existence, sometimes selecting the right platform could be a daunting task. Each exchange is unique in terms of fees and security. That is why comparing all the available alternatives before making a choice helps to identify the best deal. Above all, the proper exchange has the right regulatory status.

1. Set up a BlackCoin Wallet

You might recall the discussion we had earlier about where to buy BlackCoin, and we learned that buying and holding the BLK tokens requires a wallet. Setting up a BlackCoin wallet is the first thing that should happen before the purchasing process can begin. This step is even more crucial if you intend to take charge of the coins.

For your information, several types of cryptocurrency wallets are available but it helps to realise that there are two primary categories. The first one is the hardware category. Hardware wallets are physical devices capable of generating a unique string of numbers as private and public keys. Good thing is that they do so without an internet connection. The capability to access the wallets offline makes them the most secure.

The second crypto wallet category is the software wallet. Although this category lags in terms of security, these wallets offer the best convenience. Software wallets could be:

- Desktop wallet – this is a piece of software installable on a desktop computer. Users can access these wallets offline, but they require an internet connection during setup.

- Mobile wallet – this is the same as desktop wallets only that they are installable on a smartphone. Most mobile wallets cannot operate without an internet connection, making them the most vulnerable to hackers.

- Web wallets – these are web-based, meaning they are only accessible via a browser. These wallet types are riskier than mobile wallets, and we believe they should not hold a substantial number of your BlackCoin holding.

2. Choose and Join an Exchange that sells BlackCoin

With the wallet ready, it is time to start buying BlackCoin. To do so, you need to create an account on the preferable exchange. Some popular exchanges that list BlackCoin include Bittrex, Binance, AEX, Coinmama, and LiteBit.eu.

Each of the exchanges mentioned above, and many others that offer BlackCoin, maintain a different standard when it comes to onboarding new clients. It means different levels of strictness in the KYC process, and varying depths of personal details required. We recommend exchanges whose regulatory status is verifiable because they are a safer place to purchase BlackCoin.

3. Choose Your Payment Methods to Buy BlackCoin

On the “Deposit” tab of most exchanges, you will find a list of supported payment methods. It is not clear what criteria the exchanges use to select the options but the assumption is that the selection is based on high-security standards and professionalism. However, serious investors do not take the exchanges’ word for it.

It is important to realise that the payment methods differ in terms of the fees charged and the time taken to settle transactions. For example, bank transfers offer the highest security because the banks take charge of the entire fund transfer process. However, the rigorousness of their protocols makes for very slow transaction speeds.

On the other hand, online payment service providers such as PayPal offer great convenience. The problem here is that the services are not available everywhere globally. Another alternative is debit and credit cards. These cards offer the fastest transaction speeds but sometimes at a steeper cost.

4. Place an Order to Buy BLK

Allow us to begin this section with a caveat. While BlackCoin is a popular digital currency, it is not as commonly used as Bitcoin (BTC) or Ethereum (ETH). As such, the process of buying BLK is a little different from what you expect if you were to buy BTC.

The main difference is that crypto exchanges do not support a direct BLK purchase. Instead, you first have to buy a commonly used crypto such as BTC then use the BTC to purchase BLK. When you fund your account through the preferred payment method, the next step involves buying the digital currency for use to buy BlackCoin.

With the crypto secured, navigate to the “Markets” or “Exchange” section of the trading platform. In the search box at the top (it could be top-left or top-right depending on the platform), type in BlackCoin and press Enter. Several results should pop up, each one asking you to buy BlackCoin with a different cryptocurrency i.e., Buy BlackCoin with Bitcoin (BTC).

Specify the BLK amount you wish to buy and the platform will produce the corresponding Bitcoin amount automatically. Verify that all the information is in order and then click ‘BUY’. You should receive a notification with information on the status of the order.

5. Safely Storing Your BlackCoin in a Wallet

It shouldn’t take long to receive the BLK tokens after placing the order. When the coins land in the exchange account, you can elect to let them stay there or move them to a private wallet. The decision here depends on your ultimate goal. Do you intend to trade short-term BLK price fluctuations? If so, you can let the coins stay in the exchange wallet. Otherwise, the coins are better stored in a private wallet if your investment plan is long-term.

To transfer the BLK coins from the exchange to the private wallet, navigate to the “Wallet” or “Balances” section. Here, navigate to the “withdraw” tab and click on it. Most exchanges have easy-to-understand prompts that guide the withdrawal process.

Should you Buy or Trade BlackCoin?

Whether to buy BlackCoin for holding or trade the coin’s price moves is an important decision you need to make. It shouldn’t be hard to decide, especially when you are clear about your ultimate goals. If you aim to be a proud owner of BLK coins, and maybe dispose of them years later when the price is right, then buying the coins from a cryptocurrency exchange is the way to go.

Alternatively, your goal could be to experience the thrill of making tens of trades per day to capitalise on the volatility in the cryptocurrency market. In this case, trading BlackCoin is the way to go. Professional brokers offer the ideal platform for this kind of activity.

What’s the Difference Between a BlackCoin Exchange and a Broker?

We have already seen how buying BlackCoin for a long-term investment strategy differs from short-term BLK trading. This is the concept we need to distinguish an exchange from a professional broker. A BlackCoin exchange brings buyers and sellers together to exchange other digital currencies for BLK tokens and vice versa. Interaction on the exchange’s platform is peer-to-peer and investors trade at the market price.

Brokerages, on the other hand, offer BlackCoin via contracts for difference (CFDs) and other derivatives such as futures. These derivatives are the instruments that the clients then trade. The derivatives enable clients to trade both sides of the market, which is impossible on the exchange, and do not require ownership of the coins. However, they do not entitle the owner to absolute ownership for long-term investments.

BlackCoin: Long Vs Short Term Investment

Even when you buy BlackCoin from an exchange, it is possible to implement two different investment approaches, long-term and short-term. A long-term investment approach assumes the possibility of BlackCoin value increasing substantially in the future. It involves locking the BLK tokens down in a private wallet without the intention of withdrawing.

The short-term investment approach targets the BLK price changes soon. This approach anticipates the BLK price to shoot up in a matter of days after which you sell your holding. This investment strategy is ideal when the crypto market is in a volatile phase.

3 Tips to Buy BlackCoin

So, you have decided to buy BlackCoin? Here are a few tips for your benefit:

1. Choose the Right Time and Do Your Own Research on BlackCoin

No one knows the right time to buy BlackCoin until after conducting extensive research. The research should help you to determine if the BLK tokens are undervalued. If they are undervalued, then this is the perfect time to buy. Also, ensure that the research is original to avoid picking potentially flawed conclusions from other people’s work.

2. Comparing Costs to Buy BlackCoin

Each exchange is a business trying to squeeze as much profit as possible, which explains why they charge varying fees. You might be surprised to find that some cheap platforms offer just as good services. Therefore, make sure to compare the costs of all platforms before settling for the preferred one.

3. Safety and Security when Buying BlackCoin

Besides targeting low-cost platforms, check out the security protocols and ensure they suffice. You could add an extra layer of security by configuring a two-factor authentication feature for your profile.

What is the Best Payment Method for Buying BlackCoin?

- Buy BlackCoin with Cash – buy other cryptos with cash, then use them to buy BlackCoin.

- Buy BlackCoin with Credit Card – most exchanges support transactions with credit cards.

- Buy BlackCoin with Bank Transfer – highly secure but might take longer than alternatives.

- Buy BLK with Bitcoin – the most common payment method for buying uncommon altcoins.

- Buy BlackCoin with PayPal – offers fast transaction speeds and top-notch convenience.

Other Ways to Buy BlackCoin

BlackCoin is a hybrid blockchain and its native coin (BLK) is minable using commonplace GPUs and processors. The PoS protocol supports staking, where users open-source their wallets for supporting the security of the BlackCoin network. In exchange, the users earn rewards ranging from 1%-8% of their stake annually.

The BlackCoin blockchain is one of the few open-source networks fully focused on creating a reliable smart contract client. Also, the recent switch from proof of work to proof of stake system indicates the core developer team wishes to avoid the pitfalls that befell Bitcoin. Given time, we believe that the BlackCoin project has a lot to offer.

Frequently Asked Questions

-

BlackCoin is a blockchain project that is part of the pioneers of the proof of stake consensus systems. The peer-to-peer network operates as a smart contract client on top of which developers can build limitless applications. The BLK tokens facilitate transactions within the network.

-

Yes. Several cryptocurrency exchanges offer a platform to buy BlackCoin using digital currencies such as Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and others.

-

The only way to know when to buy BlackCoin is through conducting market research. The research should answer questions like, is the current value of BlackCoin (BLK) tokens fair? If not, then it could be the right time to buy.

-

Going short on BlackCoin means you have a pessimistic view of the BlackCoin future value. If the insights from due diligence tell you that the BLK price could decline soon, it is okay to go short.

-

You can short BlackCoin on any cryptocurrency brokerage platform that lists the digital currency. Our opinion is that you should perform due diligence on several brokers and only select one that is established enough and has proper licenses that can be verified.

Alternative Cryptocurrencies